Join our fast-growing community

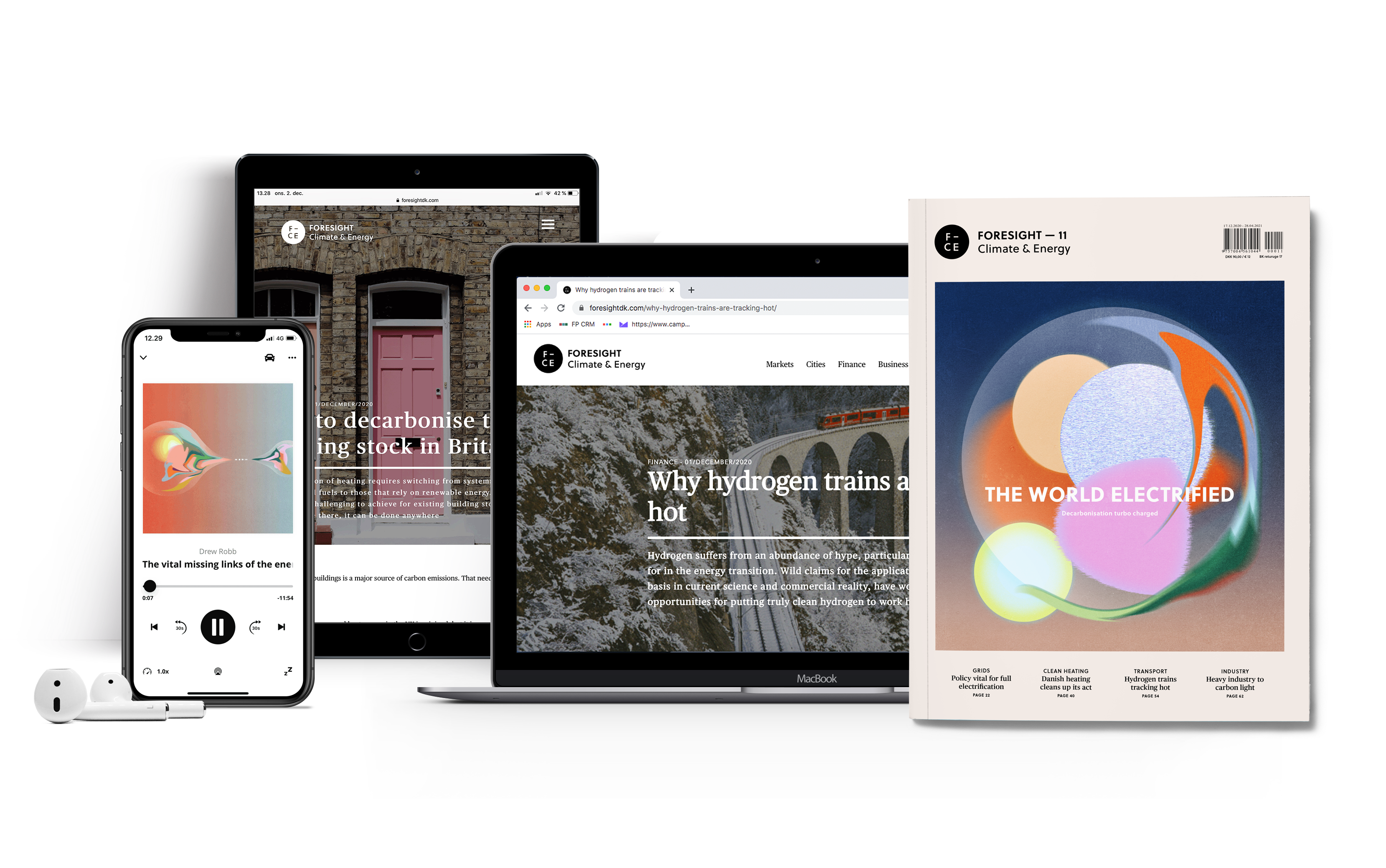

Experience global experts in pivotal debates around FORESIGHT's in-depth journalism on the essential development in the energy transition. Don't miss potentially critical discussions revealing developments affecting your business. Always available in the app for our busy members, accessible anytime, anywhere.

30 DAYS FOR JUST €29What people say about us

Lisette van Doorn, Chief Executive, ULI Europe

FORESIGHT member

We see great potential in the platform that FORESIGHT is building. It connects experts from all parts of the built environment to co-create and engage in in-depth debates.

Stef Goosen, CEO, 3E

FORESIGHT member

FORESIGHT’s commitment to in-depth journalism resonates deeply with our core values.

Tarak Metha, President, Motion Business, ABB

FORESIGHT member

It was natural for us to support the in-depth and constructive journalism at FORESIGHT, a trailblazer in its field.

Malgosia Bartosik, Deputy CEO, Wind Europe

FORESIGHT member

FORESIGHT Climate & Energy is an anchor of sensible insight in the storm of fast news.

Kristian Ruby, Secretary General, Eurelectric

FORESIGHT member

Well-researched, in-depth energy journalism.

Derk Swider, Vice President Economics, Policy and Foresight, EON

FORESIGHT member

For us, FORESIGHT Climate & Energy is an essential source of deep-dive coverage that helps shape our understanding of the global energy transition.

What you will enjoy

Complexity simplified: Gain a clear, concise understanding of the intricate energy transition.

Listen anywhere, anytime: Seamlessly integrate in-depth energy insights, debates, and our expert news format into your busy schedule with our audio content.

Engage: Get involved in the energy dialogue through interactive commentaries, open editorial meetings, and collaborative solution-building directly in the app.

GET A TASTE

30-day trial

€29

first month

Auto renews at €79 per month

Cancel anytime

New members only

Try us

Enjoy unrivalled analysis of the global energy transition online, in print and in audio.

Industry leading podcasts

Our world-leading podcasts can be integrated seamlessly into your daily routines.